Navigating Global Tariffs The Rise of Chinese Manufacturing in Gearbox and Lenze Gearmotor Supply

In the increasingly complex landscape of global trade, the dynamics surrounding tariffs and manufacturing have dramatically shifted, particularly impacting sectors like gearbox and gearmotor production. As highlighted in recent reports from industry analysts, the global gearbox market is projected to reach approximately $38 billion by 2026, with a notable rise in demand for efficient and cost-effective solutions. In this context, the rise of Chinese manufacturing, including significant players in the Gearboxlenzegearmotor domain, has emerged as a powerful counterforce against the backdrop of escalating U.S.-China tariffs. Despite the deterrents posed by these tariffs, China's adaptability and investment in advanced manufacturing technology have enabled it to maintain a competitive edge, with Chinese manufacturers capturing a significant share of the global market. As businesses navigate these challenges, understanding the implications of tariff fluctuations and the strategic positioning of Chinese firms will be crucial for stakeholders in the gearbox and gearmotor sectors.

The Impact of Tariff Policies on Global Supply Chains in the Gearbox Industry

The impact of tariff policies on global supply chains in the gearbox industry has become increasingly significant in recent years. As countries navigate economic pressures and seek to protect domestic industries, tariffs imposed on imports can disrupt established supply chains. This has been particularly evident in the gearbox and gearmotor market, where Chinese manufacturers have risen to prominence. The introduction of tariffs not only raises production costs but also incentivizes manufacturers in other regions to reassess their sourcing strategies.

For manufacturers of gearboxes, the choice of suppliers has grown increasingly complex. The need to mitigate tariff impacts has pushed companies to explore local sourcing options or to diversify their supply bases to include countries with favorable trade relations. As a result, the geographical landscape of the gearbox industry is shifting, with companies weighing the benefits of proximity against potential cost increases from tariffs. This dynamic environment encourages innovation in logistics and supply chain management, as businesses seek effective solutions to remain competitive in a globally disrupted market.

Navigating Global Tariffs: The Rise of Chinese Manufacturing in Gearbox and Lenze Gearmotor Supply

| Country |

Tariff Rate (%) |

Market Share in Gearbox Industry (%) |

Growth Rate (2023-2025) (%) |

Major Exporters |

| China |

5 |

42 |

7 |

Lenze, Siemens |

| Germany |

2 |

30 |

4 |

SEW Eurodrive, Nord Drivesystems |

| USA |

10 |

15 |

3 |

Boston Gear, Reliance |

| Japan |

3 |

10 |

2 |

Shimpo, Mitsubishi Electric |

| Italy |

6 |

10 |

5 |

Baldor, Techtop |

Chinese Manufacturing Resilience Against U.S.-China Tariff Challenges

The ongoing U.S.-China tariff challenges have significantly impacted global trade dynamics, particularly in the manufacturing sector. Despite these hurdles, Chinese manufacturers have demonstrated remarkable resilience, especially in the production of gearboxes and Lenze gearmotors. According to a report by the International Trade Administration, China accounted for over 30% of the global gearbox market share in 2022. This dominant position can be attributed to a combination of competitive pricing, advanced manufacturing technologies, and robust supply chain management.

Moreover, industry analysts predict that by 2025, the demand for electric motors—including gearmotors—is expected to increase by approximately 7% annually. The ability of Chinese manufacturers to adapt to tariff impositions with innovative solutions and efficient production methodologies has enabled them to maintain and even expand their market share. A recent survey from the Manufacturers' Association found that around 65% of Chinese companies have reported investing in automation and smart manufacturing techniques to enhance productivity and reduce costs, thereby positioning themselves favorably in the face of tariff-related challenges.

Key Strategies Employed by Chinese Gearbox Manufacturers for Growth

The landscape of the global manufacturing sector is undergoing a significant transformation, particularly in the gearbox industry. Chinese manufacturers have adeptly positioned themselves to capitalize on the rising demand for gearboxes and Lenze gearmotors. According to a report by Research and Markets, the global gearbox market is projected to reach $33.5 billion by 2027, with a compound annual growth rate (CAGR) of 4.5%. This growth is partly attributed to advancements in manufacturing technologies and the competitive pricing strategies employed by Chinese companies.

One of the key strategies facilitating this growth is the emphasis on innovation and quality control. Many Chinese gearbox manufacturers are investing heavily in R&D to enhance their product offerings. For instance, the use of advanced materials and precision engineering techniques has allowed for the creation of gearboxes that deliver higher efficiency and reliability. Another critical aspect is the establishment of strategic partnerships with international companies to gain access to advanced technologies and best practices, enabling them to compete on a global scale.

**Tip:** To excel in the competitive landscape, manufacturers should prioritize continuous improvement and invest in technology upgrades to maintain product quality and efficiency.

Moreover, Chinese companies are focusing on expanding their presence in emerging markets where industrial growth is rapidly increasing. According to MarketsandMarkets, the demand for gear motors in Asia-Pacific is set to grow at a significant pace, with China leading the charge. Leveraging local market knowledge and customization capabilities allows these manufacturers to meet specific regional demands effectively.

**Tip:** Engaging with local suppliers and understanding market dynamics can provide manufacturers with a competitive edge, enhancing their ability to adapt quickly to changes.

Navigating Global Tariffs: The Rise of Chinese Manufacturing in Gearbox and Lenze Gearmotor Supply

This bar chart illustrates the growth of Chinese gearbox manufacturers in terms of market share compared to their global competitors over the last five years. It highlights the increasing dominance of Chinese manufacturing in the gearbox sector.

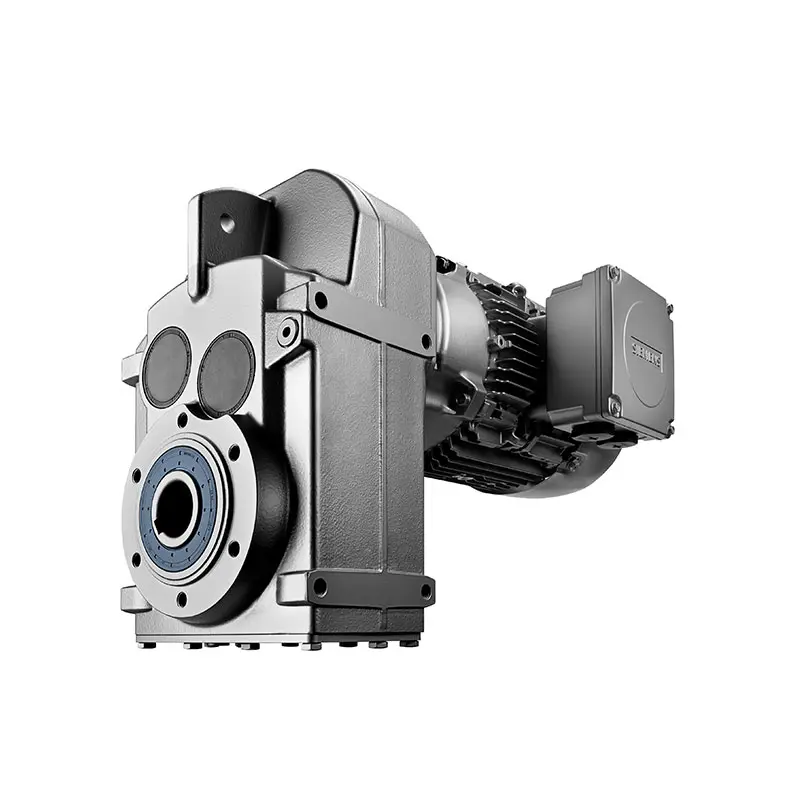

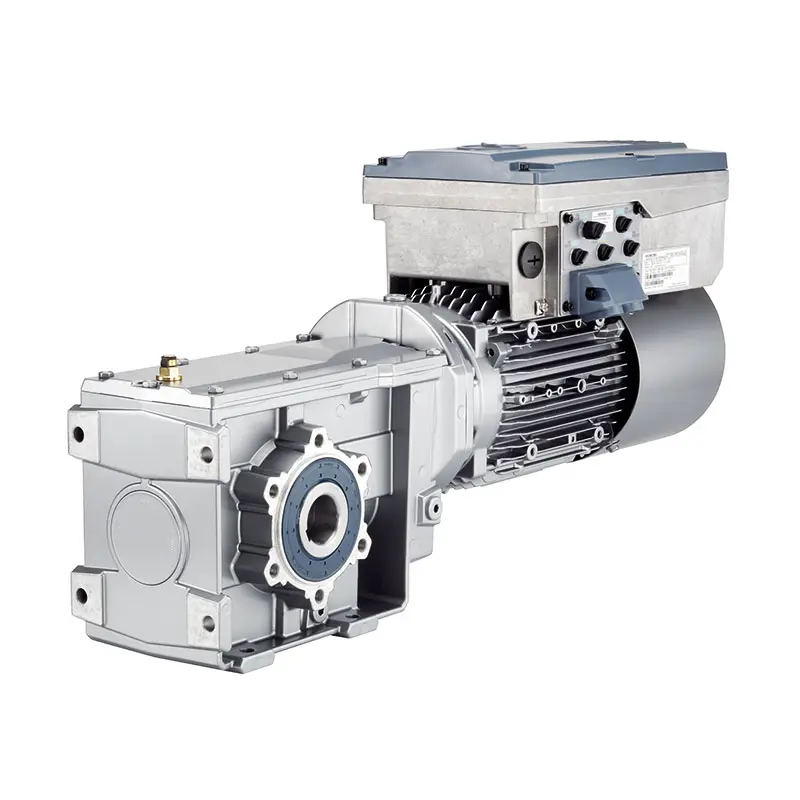

Analyzing the Competitive Edge of Lenze Gearmotor in the Current Market

In today's competitive landscape, the Lenze Gearmotor has established itself as a pivotal player in the global market, particularly amidst the surge of Chinese manufacturing and fluctuating tariffs. According to a report by MarketsandMarkets, the global gear motor market is projected to reach $16.1 billion by 2025, growing at a CAGR of 6.1%. This growth is largely driven by the increasing demand for energy-efficient systems and the accelerated pace of automation, areas where Lenze excels with its innovative solutions and robust design.

One of Lenze's competitive advantages lies in their commitment to quality and reliability, a critical factor in sectors such as logistics and manufacturing. Research from Technavio indicates that the operational efficiency offered by Lenze gear motors can reduce energy consumption by up to 25%, making them an attractive choice for companies aiming to minimize costs. Additionally, Lenze's strong emphasis on customer support and tailored solutions further enhances their market position, allowing them to effectively address the diverse needs of industries adapting to the rapid changes in global supply chains.

Future Trends: How Global Tariffs Will Shape the Gear Production Landscape

As global tariffs evolve, the landscape for gear production is undergoing significant transformations. Recent reports indicate that China's share in the global gearbox market is expected to rise from 20% in 2020 to nearly 35% by 2025. This surge is largely driven by the country’s robust manufacturing capabilities and competitive pricing. Key players like Lenze are adjusting their strategies to focus on localized production, allowing them to mitigate the impacts of tariffs and remain competitive in various international markets.

In this shifting environment, businesses must adapt to the increased pressure from tariffs. An effective strategy involves diversifying supply chains to reduce reliance on any single country. Companies can explore partnerships with local manufacturers to improve supply chain resilience and potentially bypass high tariff costs.

**Tip:** Regularly analyze tariff changes and their impacts on your operational costs. Staying informed will enable timely adjustments to sourcing strategies.

Moreover, investing in automation and innovative technologies can streamline gear production and enhance efficiency. As companies like Lenze incorporate Industry 4.0 principles, they not only improve productivity but also prepare themselves for the uncertainties that global tariffs introduce.

**Tip:** Consider adopting smart manufacturing practices to enhance adaptability and responsiveness to market demands, ensuring long-term sustainability in the face of global tariff fluctuations.

Home

Products

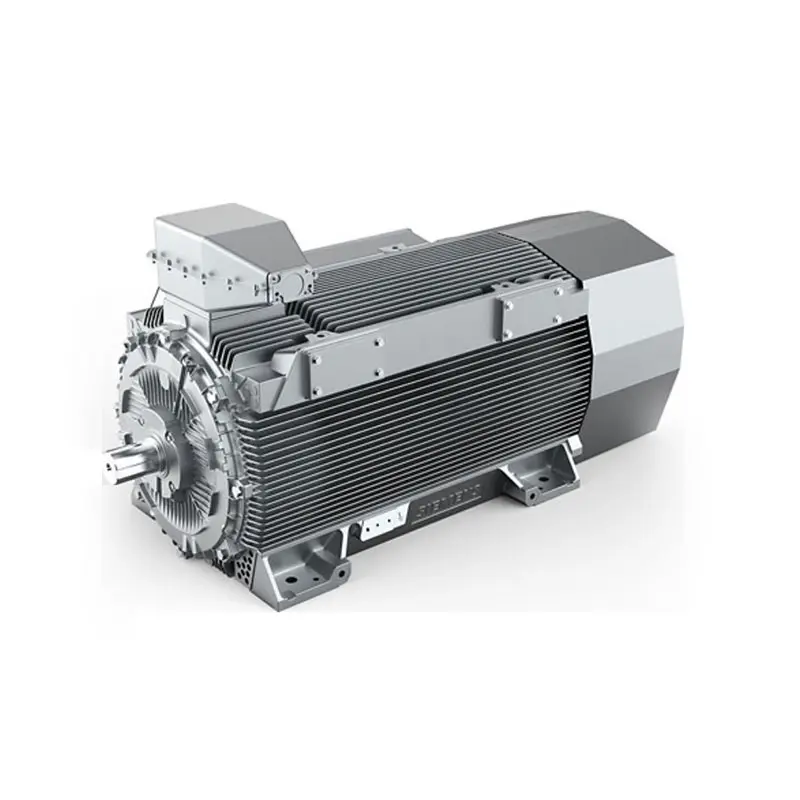

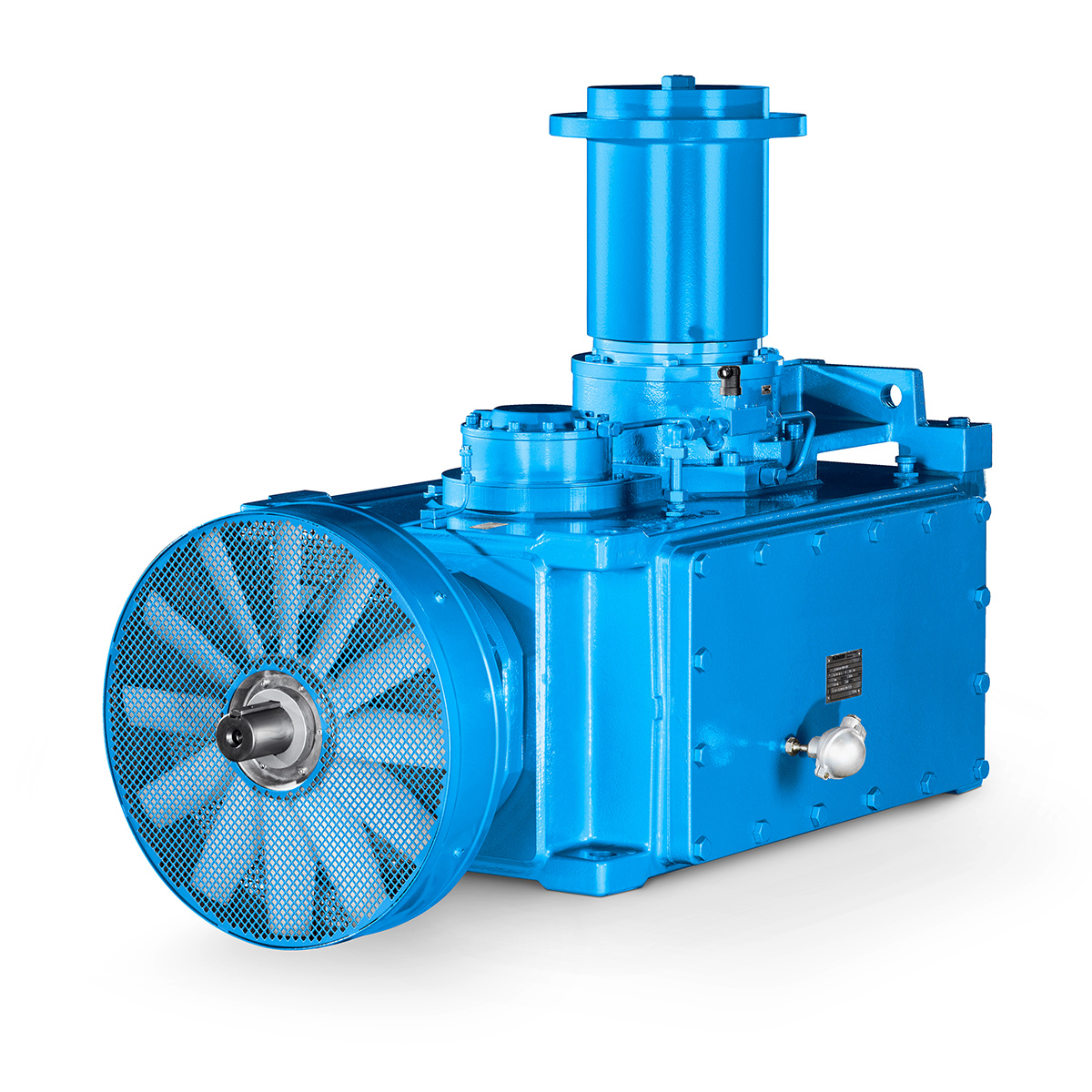

SIEMENS Gearmotor

SIEMENS Helical Gearmotor Low Voltage

SIEMENS Helical Gearmotor Low Voltage  SIEMENS Bevel Helical Gearmotor

SIEMENS Bevel Helical Gearmotor  SIEMENS Parallel Shaft Gearmotor

SIEMENS Parallel Shaft Gearmotor  SIEMENS Worm Gearmotor Low Voltage

SIEMENS Worm Gearmotor Low Voltage  SIEMENS With Servo Motor Gearmotor

SIEMENS With Servo Motor Gearmotor  SIEMENS Low Voltage Motor Low Voltage

SIEMENS Low Voltage Motor Low Voltage  SIEMENS High Voltage Motor Low Voltage

SIEMENS High Voltage Motor Low Voltage  SIEMENS Marine Motor Low Voltage

SIEMENS Marine Motor Low Voltage  SIEMENS Servo Motor Low Voltage

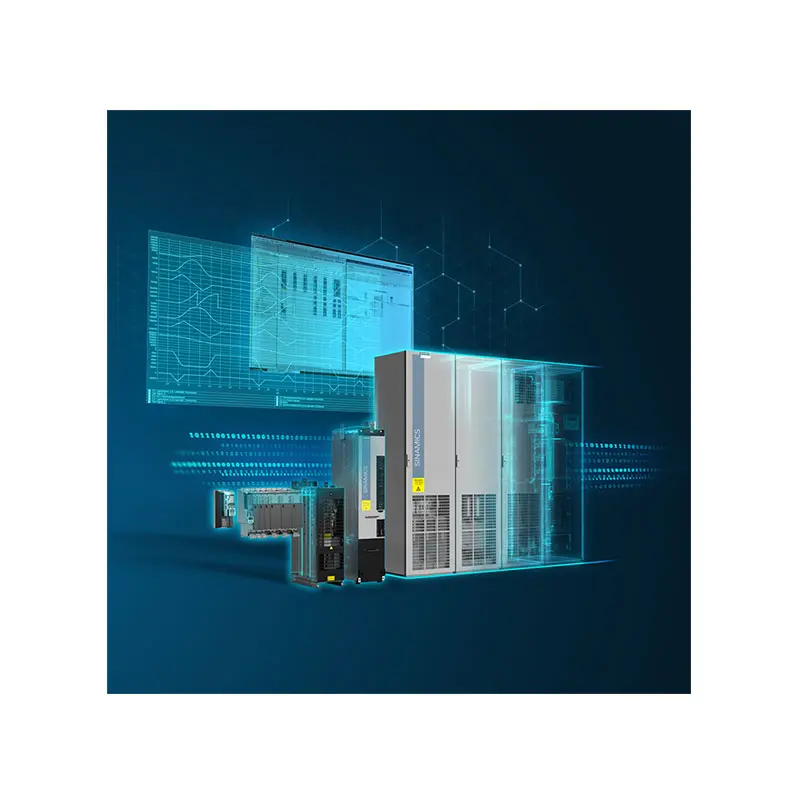

SIEMENS Servo Motor Low Voltage  SIEMENS SINAMICS S210 Low Voltage

SIEMENS SINAMICS S210 Low Voltage  SIEMENS SINAMICS S150 Low Voltage

SIEMENS SINAMICS S150 Low Voltage  SIEMENS SINAMICS S120 Low Voltage

SIEMENS SINAMICS S120 Low Voltage  SIEMENS SINAMICS G130/G150

SIEMENS SINAMICS G130/G150  SIEMENS SINAMICS G120 Low Voltage

SIEMENS SINAMICS G120 Low Voltage  SIEMENS SINAMICS G120C Low Voltage

SIEMENS SINAMICS G120C Low Voltage  SIEMENS SINAMICS V90

SIEMENS SINAMICS V90  SIEMENS SINAMICS V70 Low Voltage

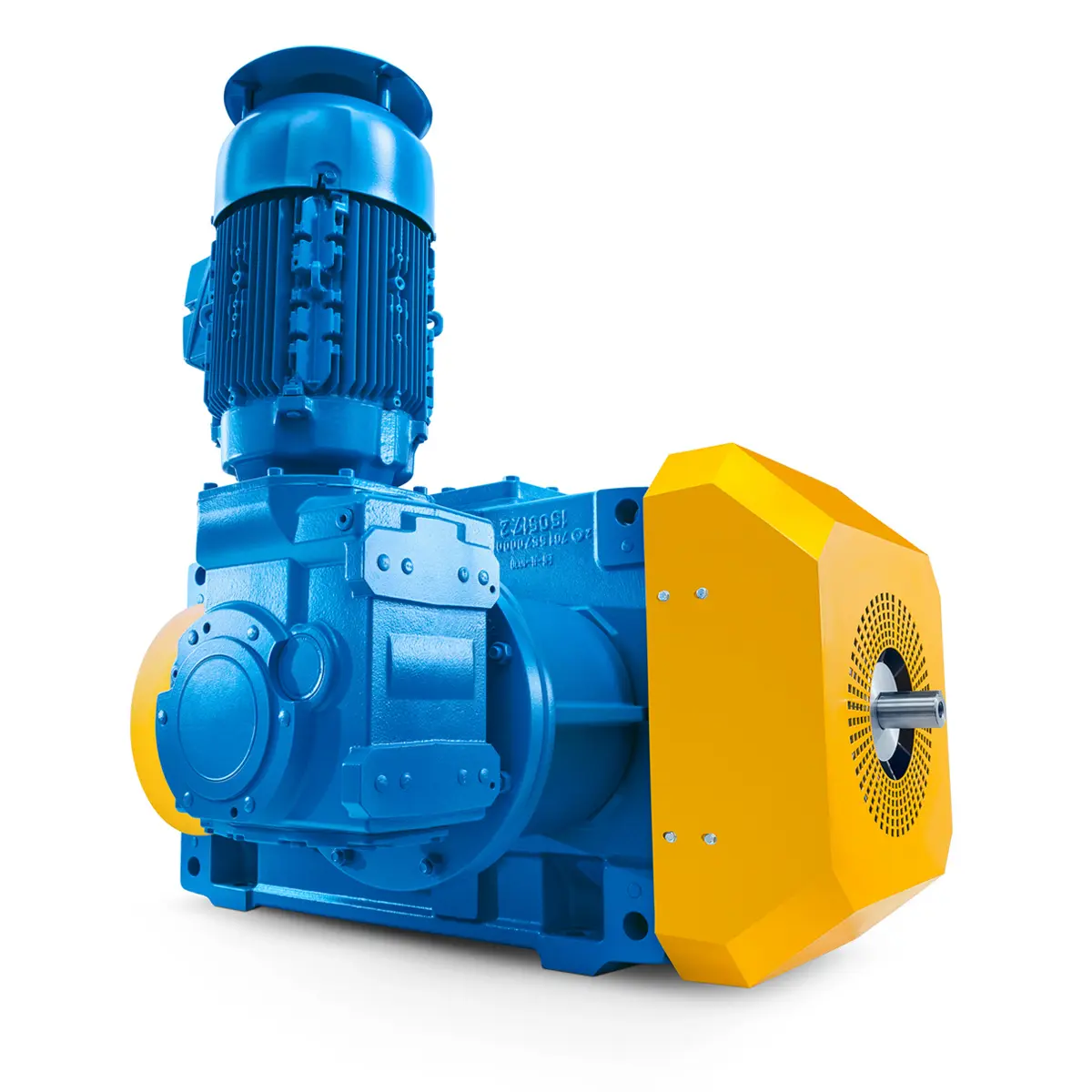

SIEMENS SINAMICS V70 Low Voltage  FLENDER Gear Unit

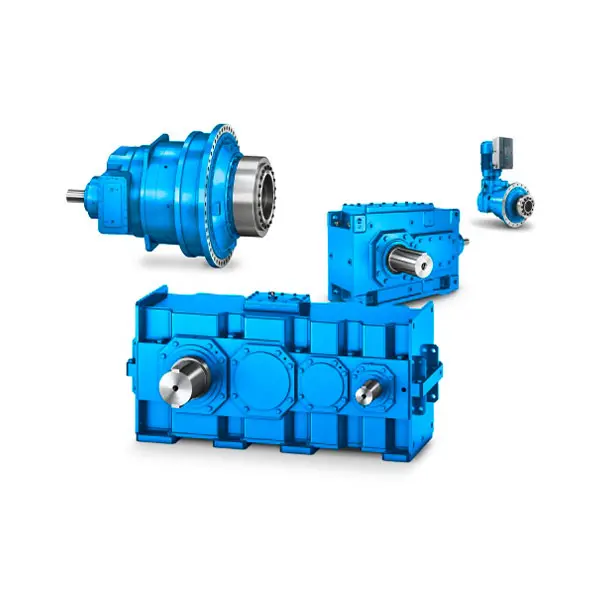

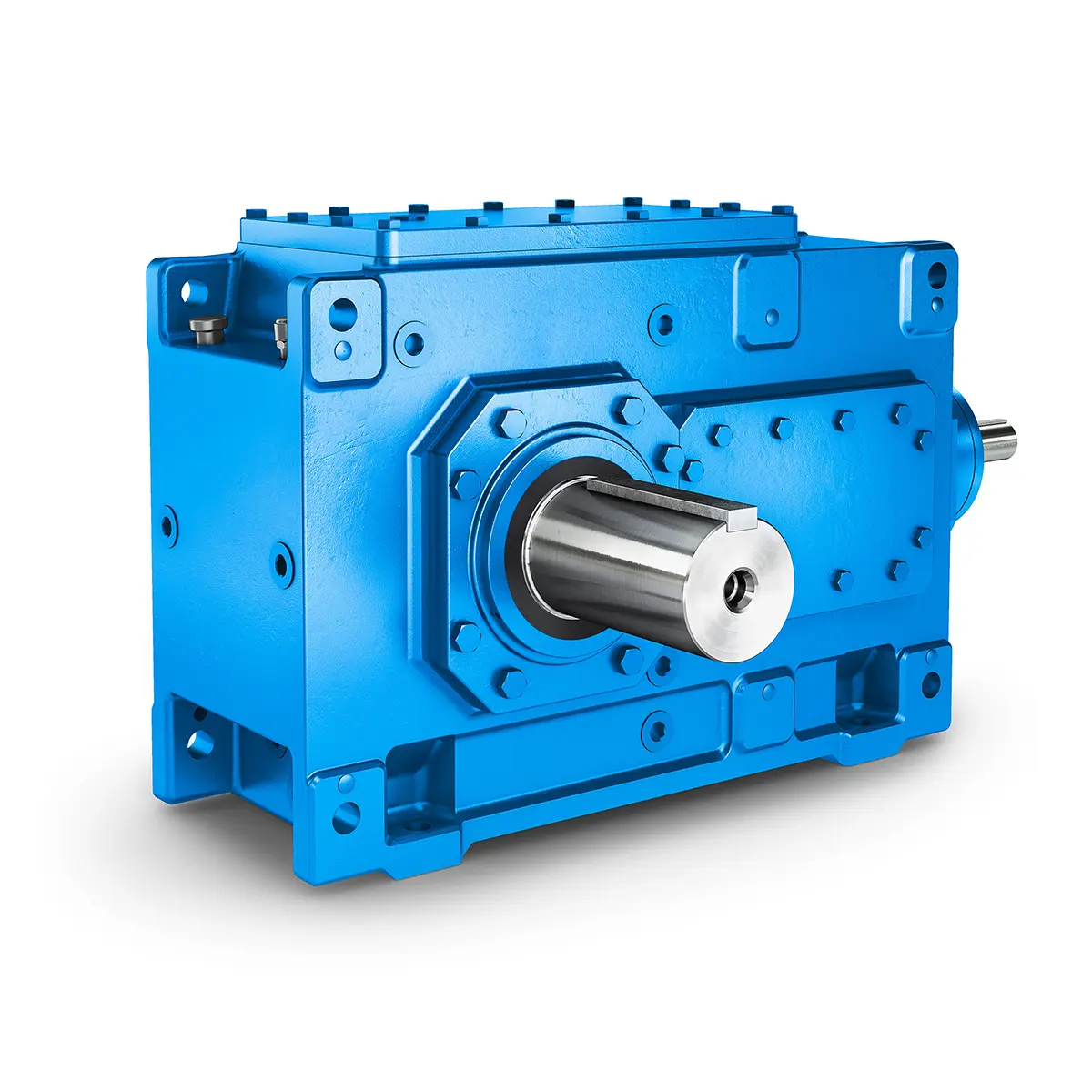

FLENDER Gear Unit  FLENDER Helical Gear Unit

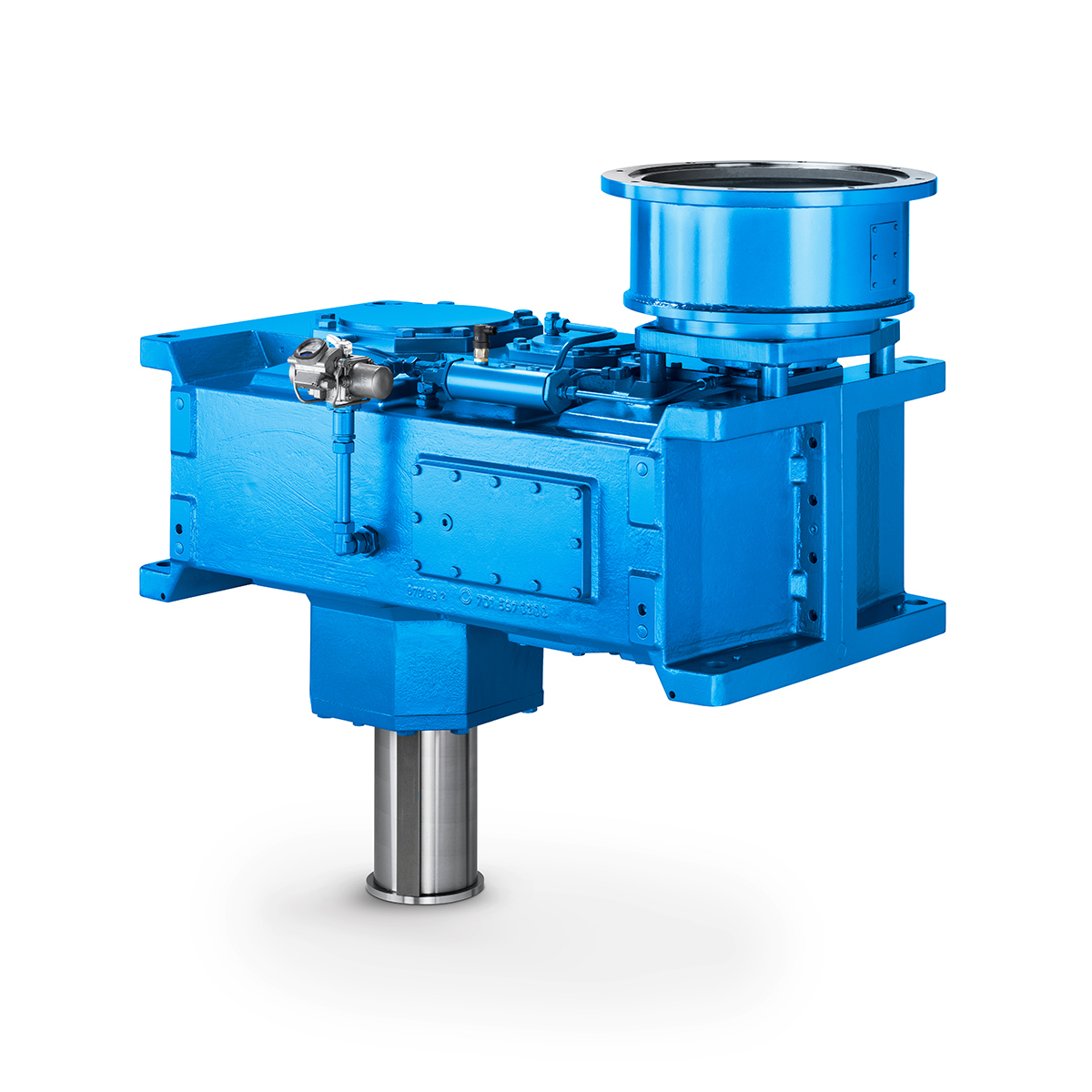

FLENDER Helical Gear Unit  Flender gear units for lifting and luffing gears

Flender gear units for lifting and luffing gears  FLENDER Gear Unit gearunit gearbox

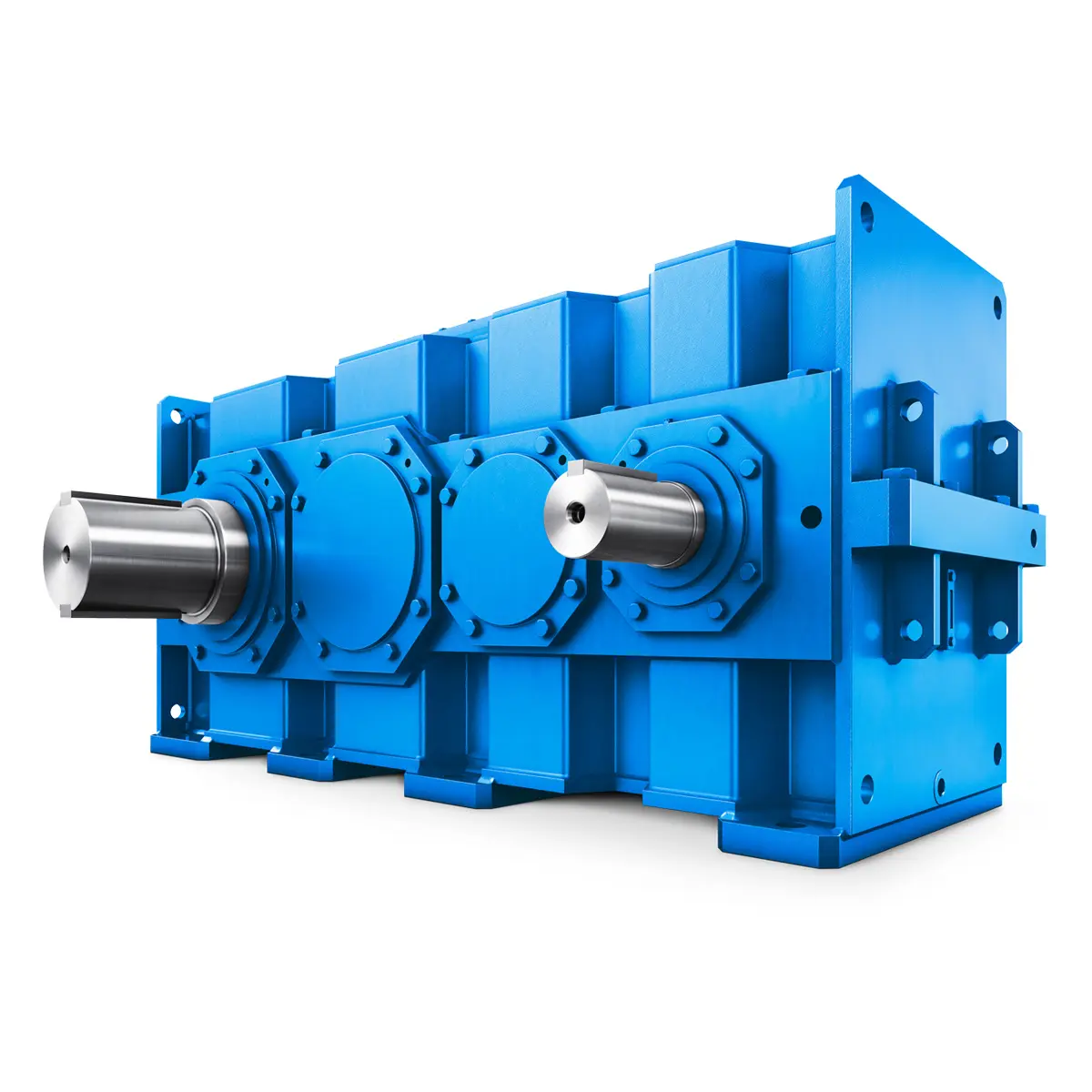

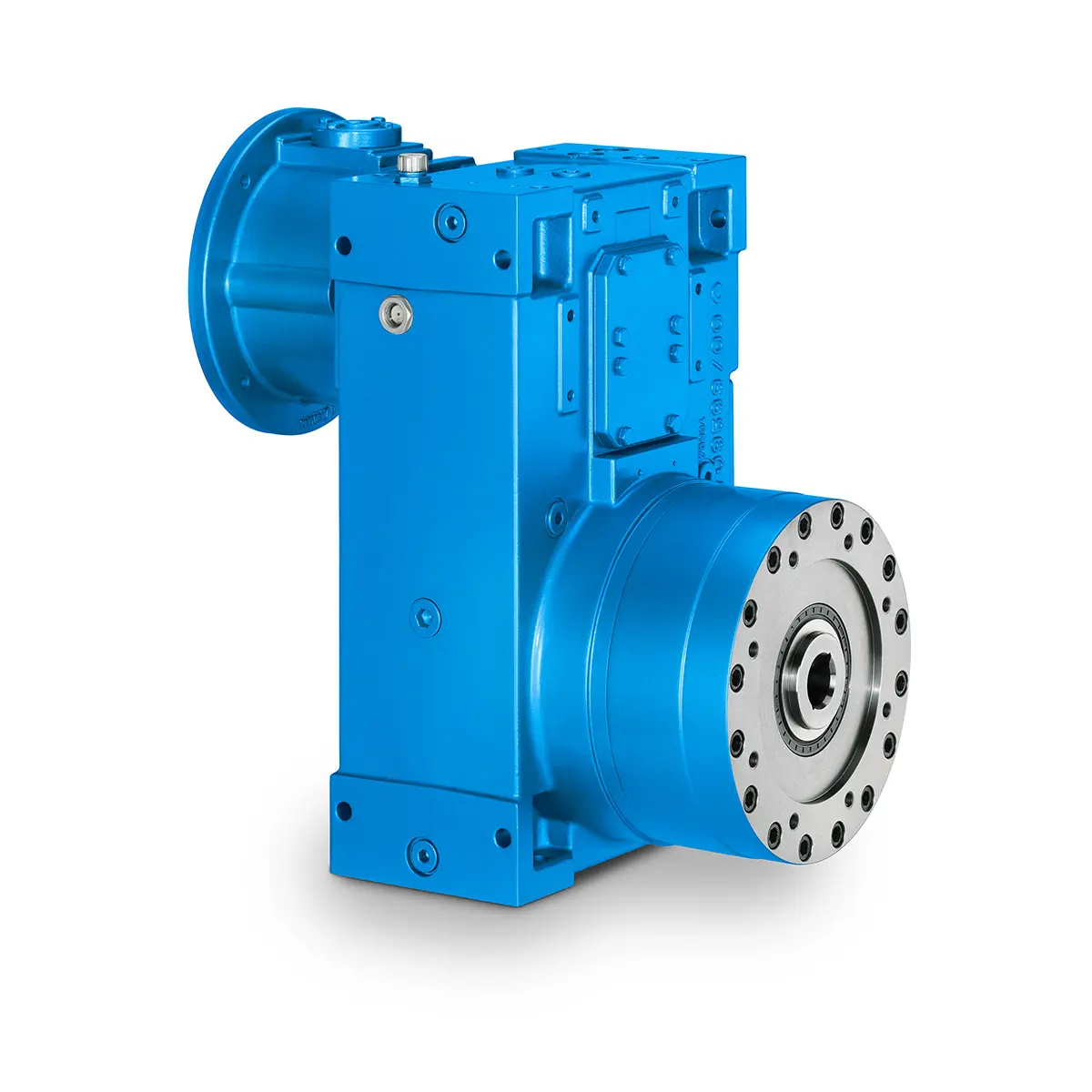

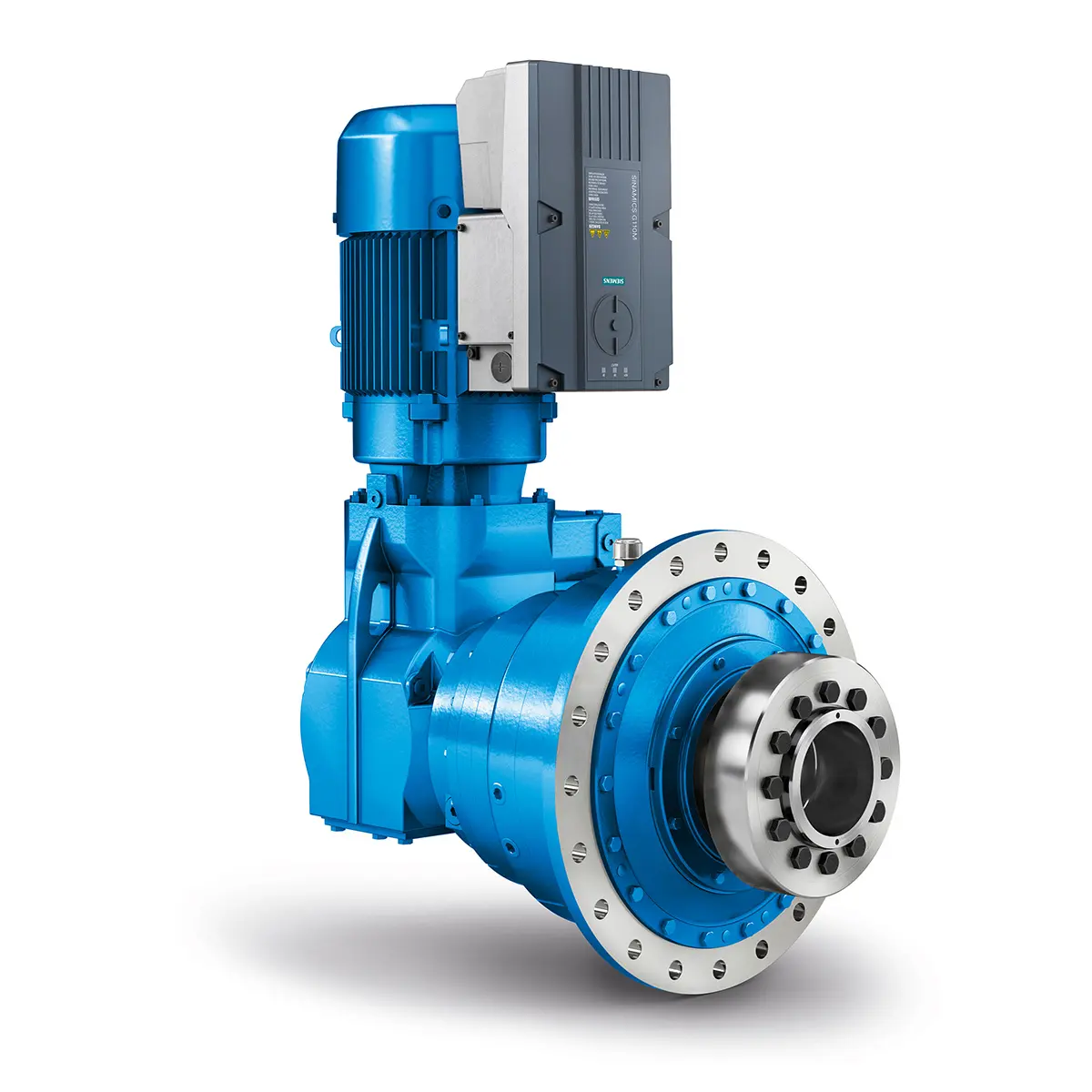

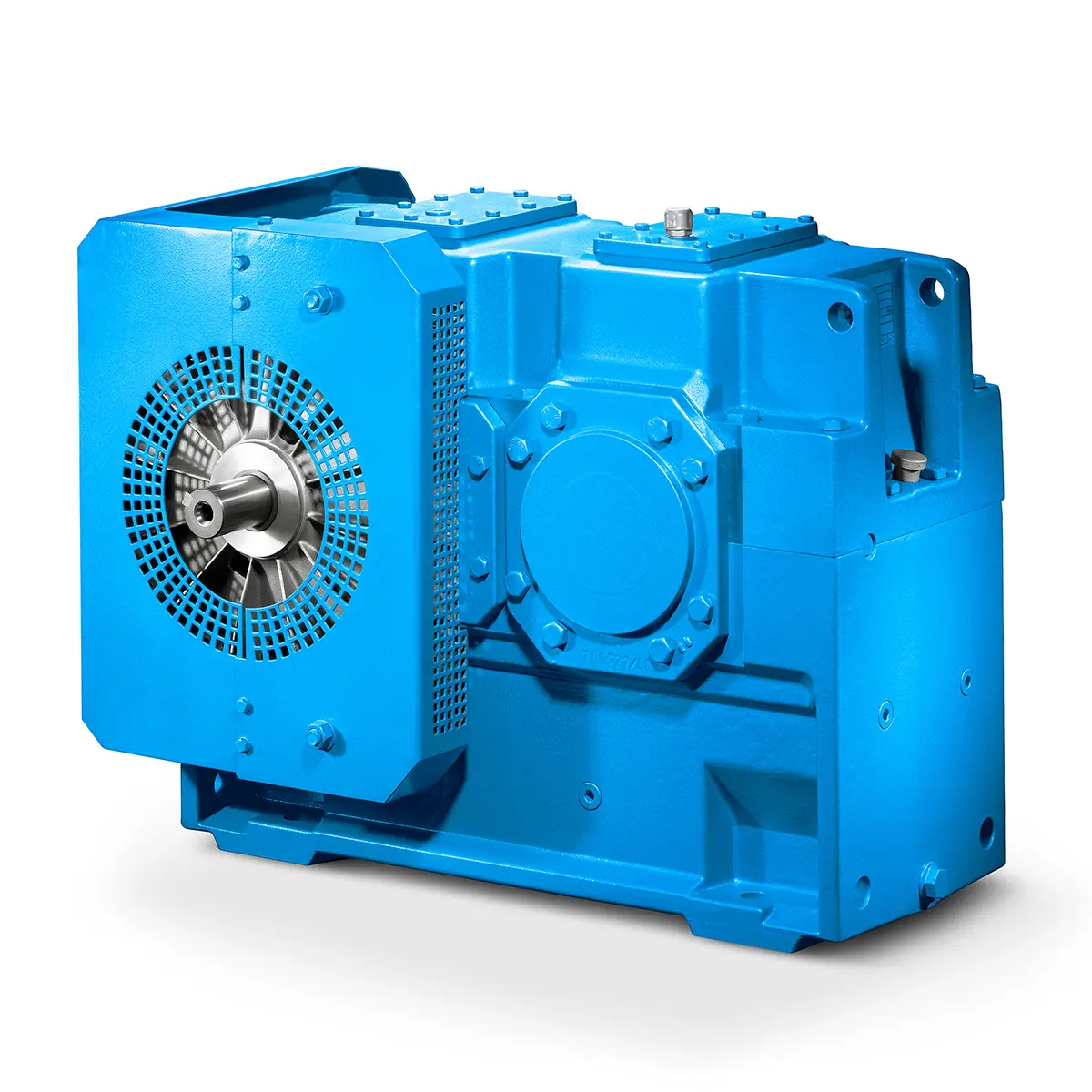

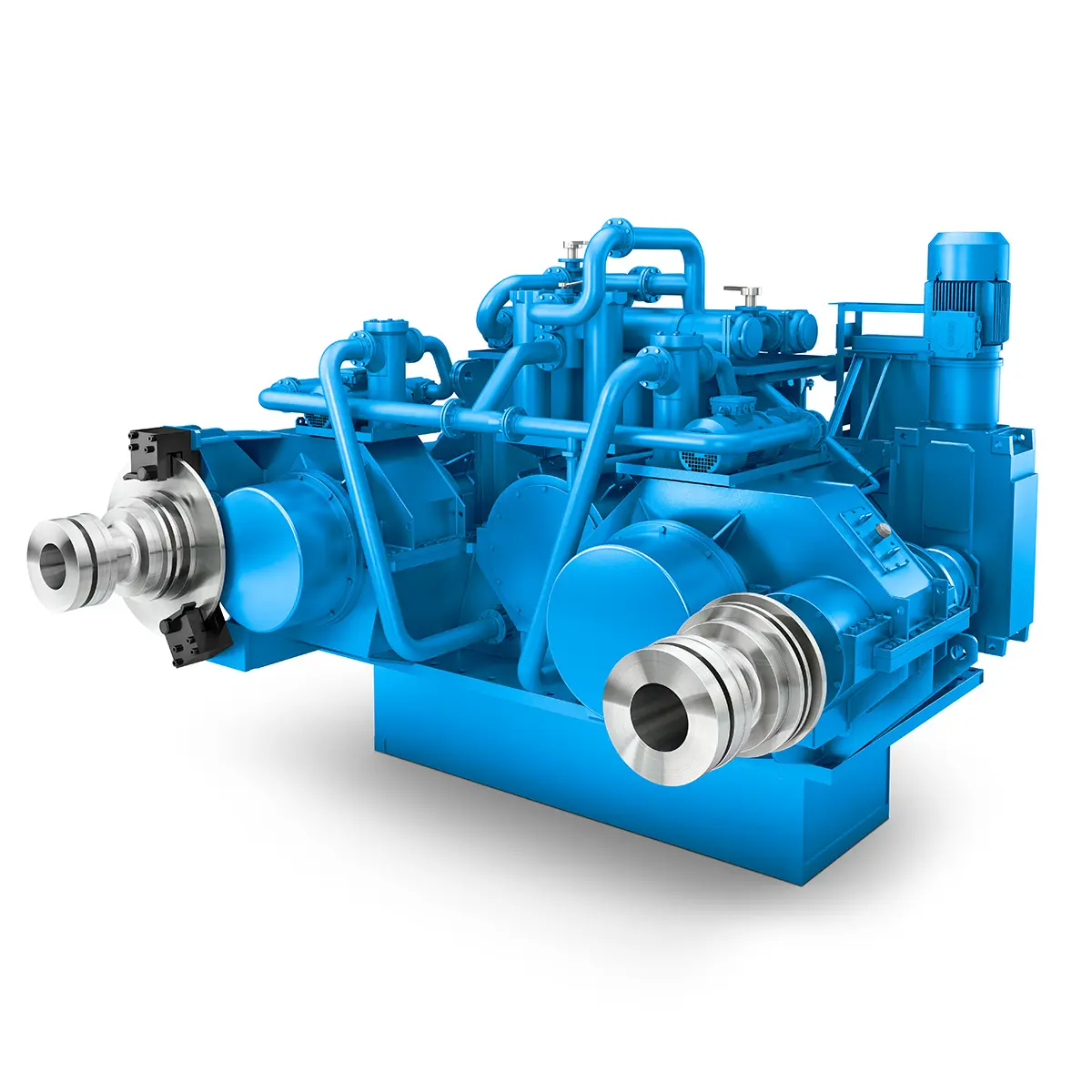

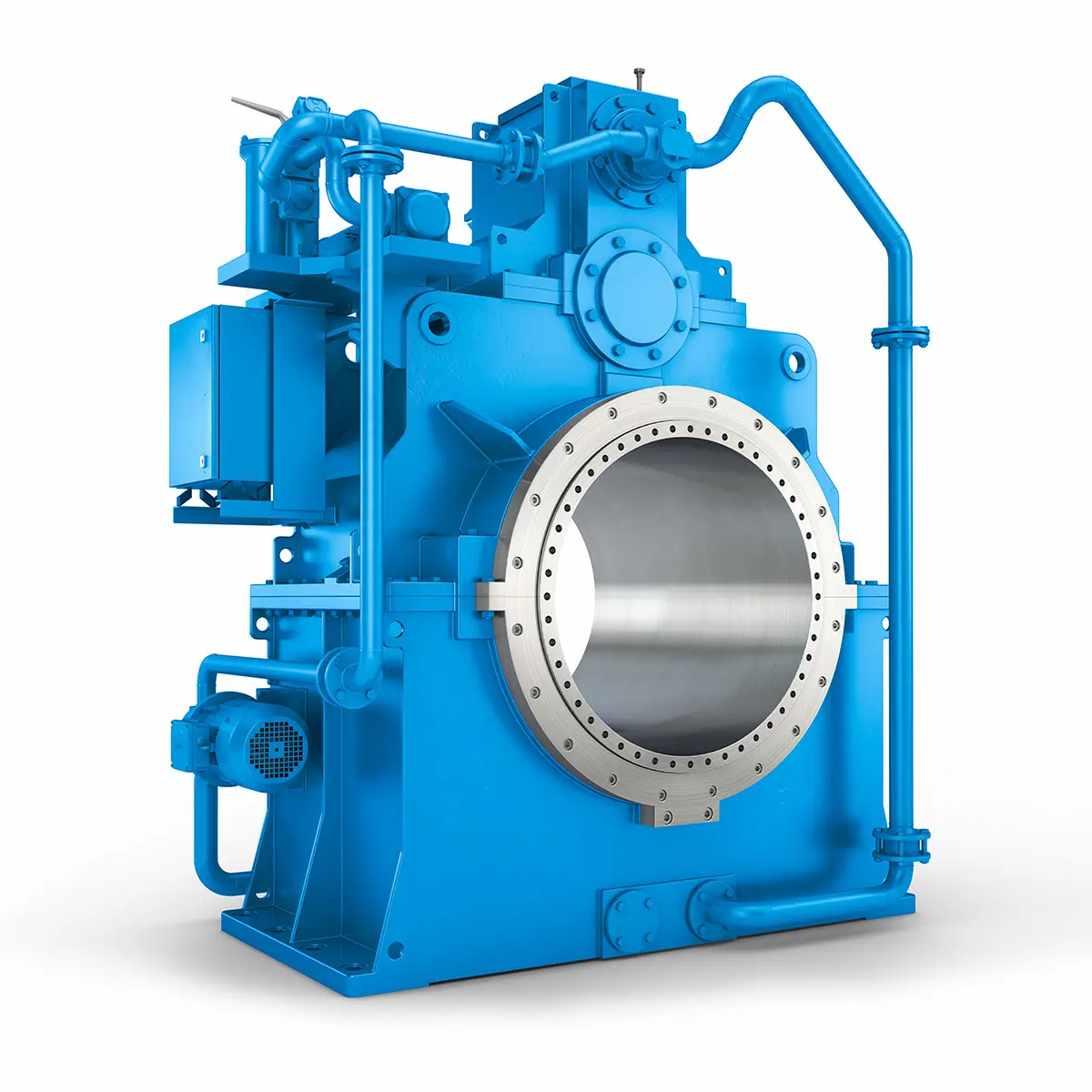

FLENDER Gear Unit gearunit gearbox  Optimal Drive Solution For Maximum Performance

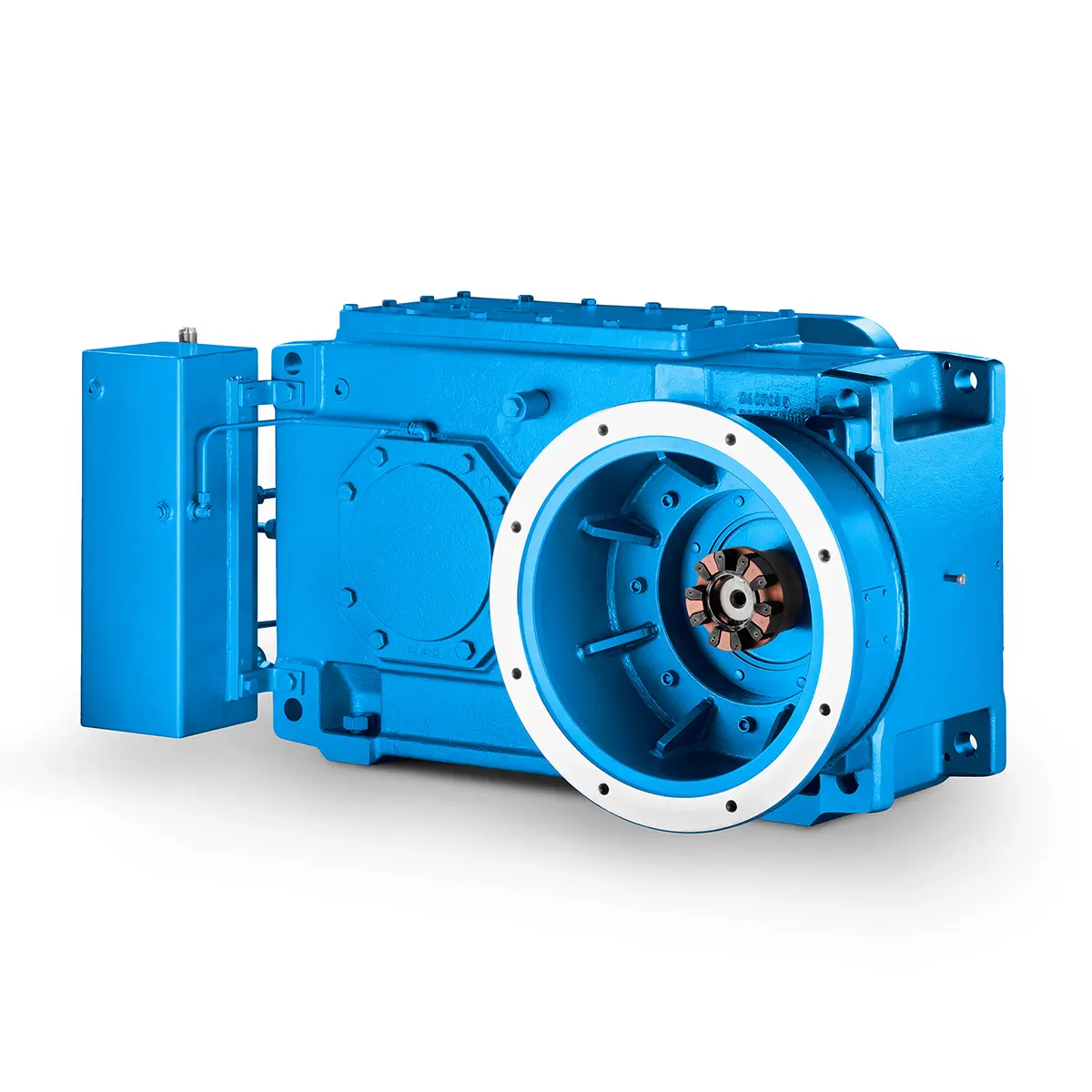

Optimal Drive Solution For Maximum Performance  Strongly operating against biodegradable constituents

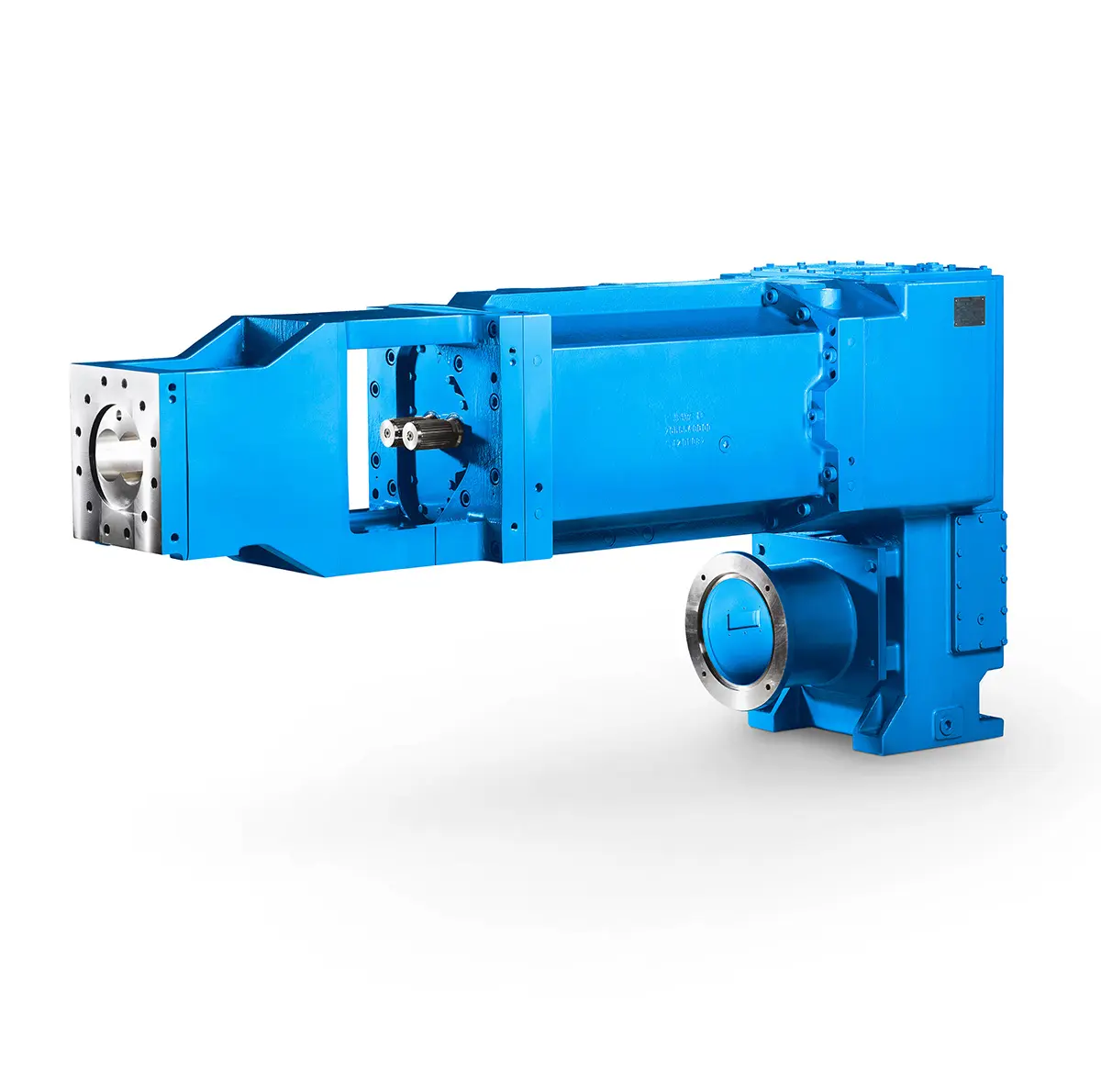

Strongly operating against biodegradable constituents  SINGLE SCREW Special industry dedicated gearunit gearbox

SINGLE SCREW Special industry dedicated gearunit gearbox  Playmaker In The Premium League

Playmaker In The Premium League  Conveyor belts gearunit gearbox

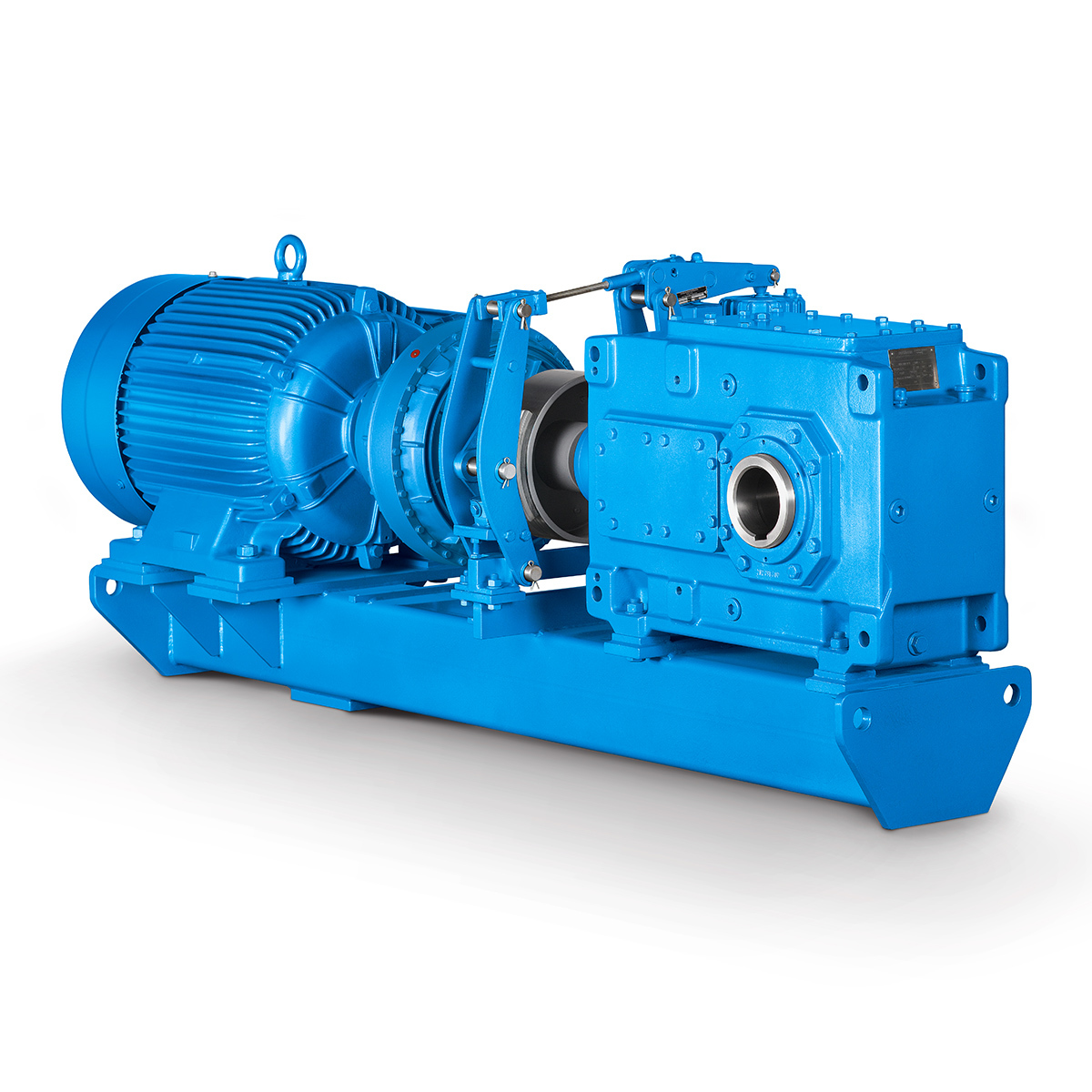

Conveyor belts gearunit gearbox  Paper And Pulp Preparation Sections

Paper And Pulp Preparation Sections  Operational Reliability Even In Case Of The Highest Ventilation Forces

Operational Reliability Even In Case Of The Highest Ventilation Forces  Reliable Gear Units For High Performance Vertical Conveyors 59/200

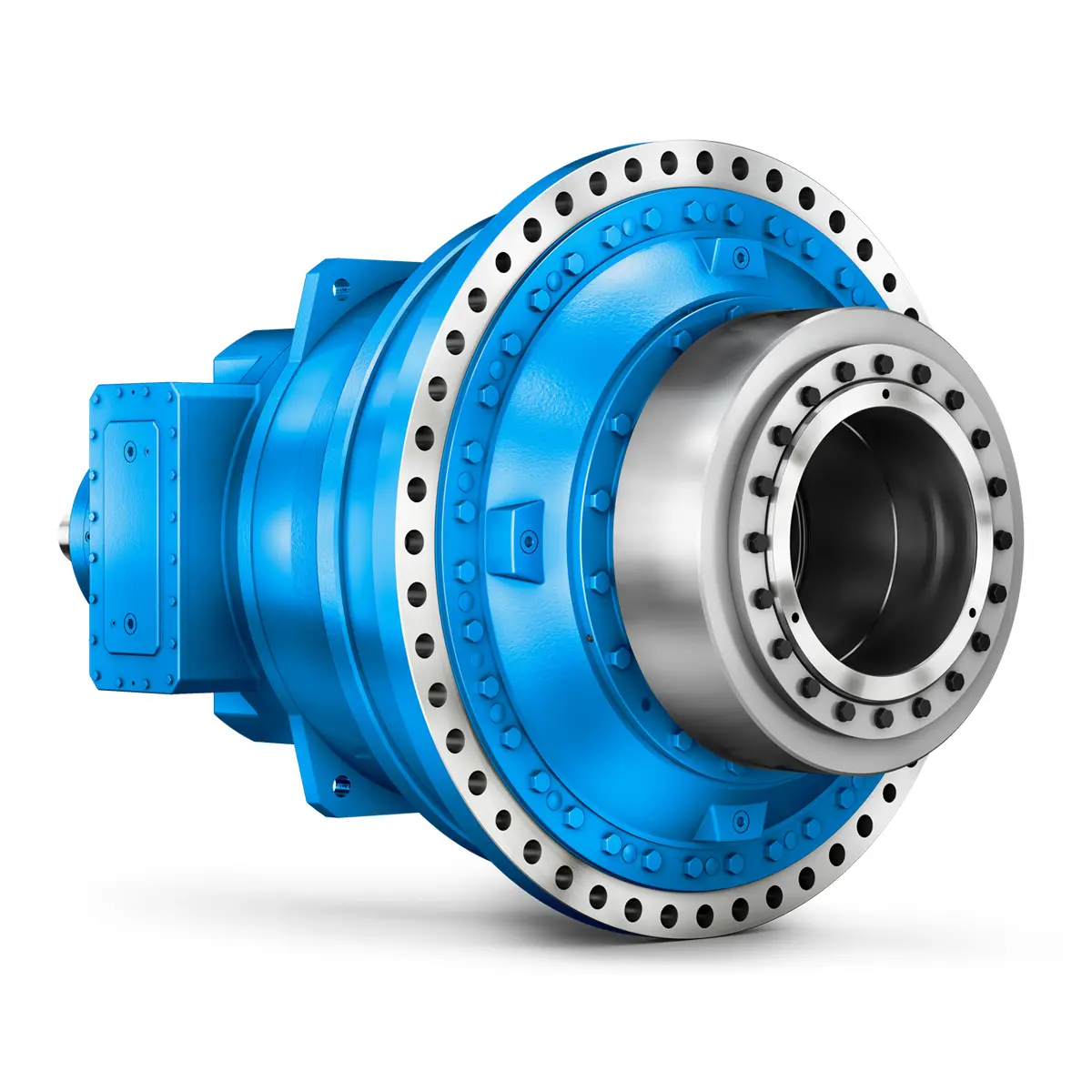

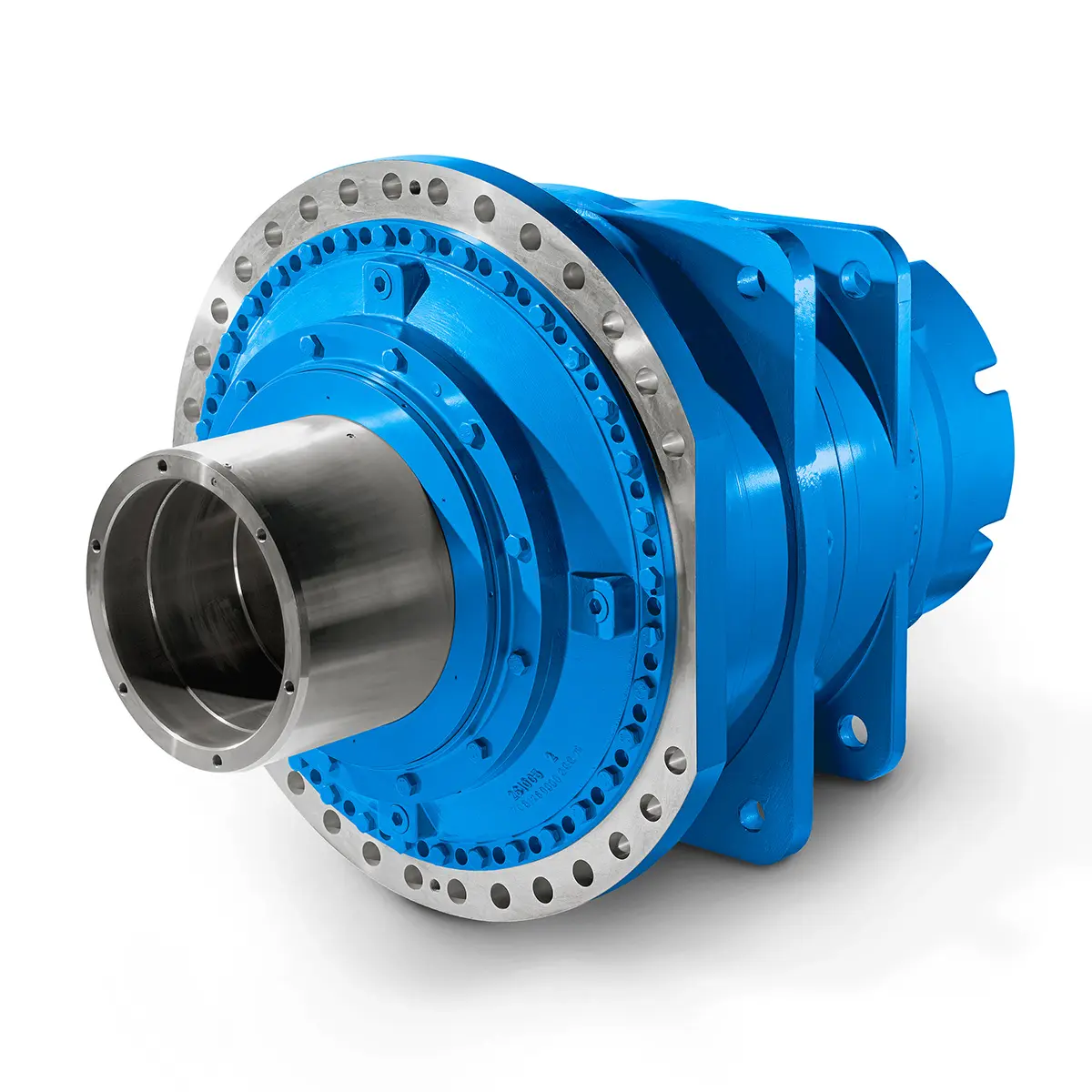

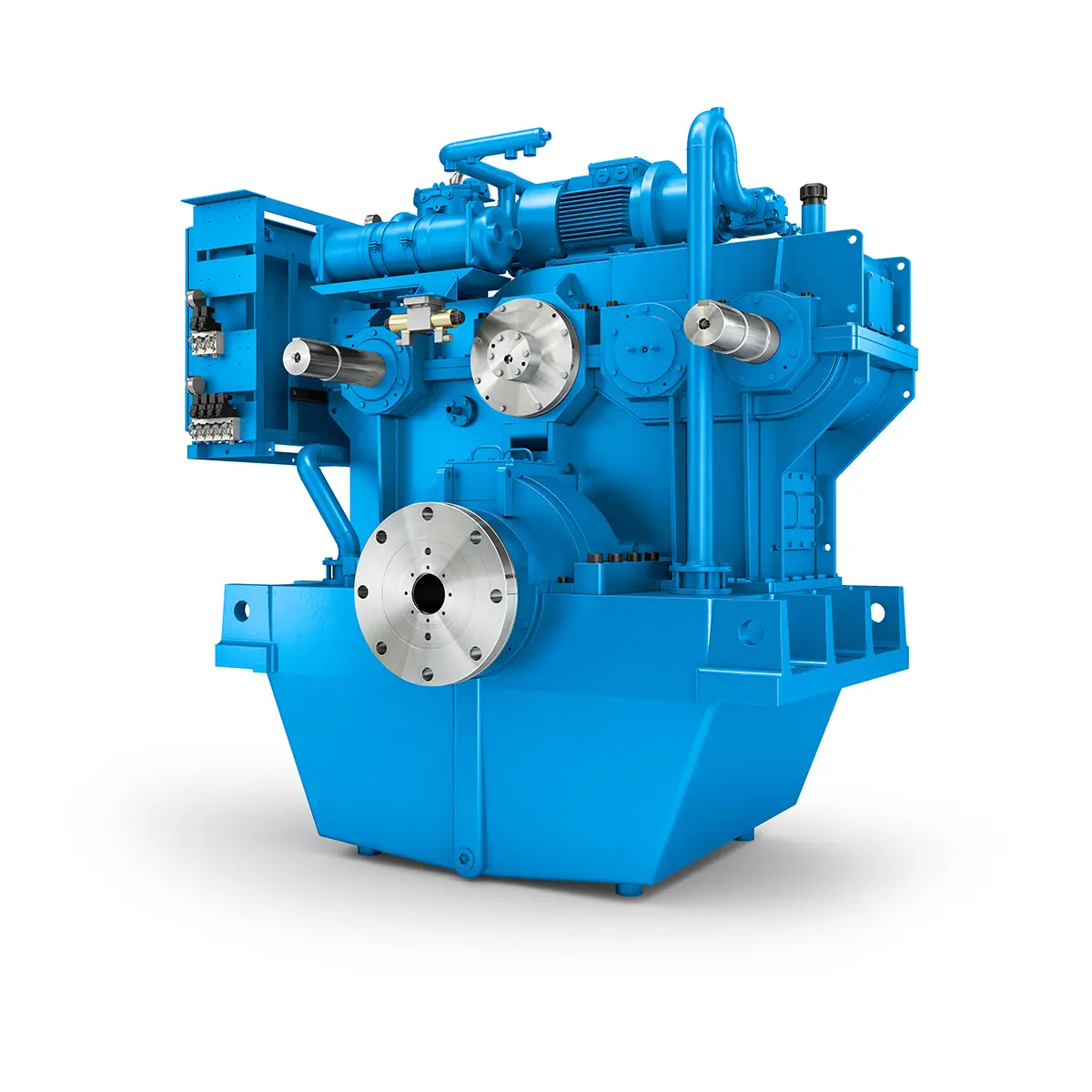

Reliable Gear Units For High Performance Vertical Conveyors 59/200  Maximum power density – PLANUREX 3 L individual drives for your sugar cane mill

Maximum power density – PLANUREX 3 L individual drives for your sugar cane mill  The proven all rounder gearunit gearbox

The proven all rounder gearunit gearbox  Stirs and stirs and stirs gearunit gearbox

Stirs and stirs and stirs gearunit gearbox  Flexibility on Board gearunit gearbox

Flexibility on Board gearunit gearbox  The right gearbox for all Multi-Engine Ships

The right gearbox for all Multi-Engine Ships  Reliable Power Generation on board

Reliable Power Generation on board  Maximum performance level, fast deliverable

Maximum performance level, fast deliverable  Efficient and compact – FLENDER Gear Units for Sugar Mills

Efficient and compact – FLENDER Gear Units for Sugar Mills  Extremely strong. Extremely compact. Extremely stressable.

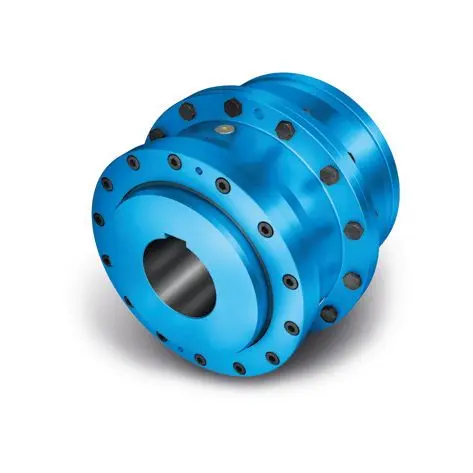

Extremely strong. Extremely compact. Extremely stressable.  FLENDER Coupling

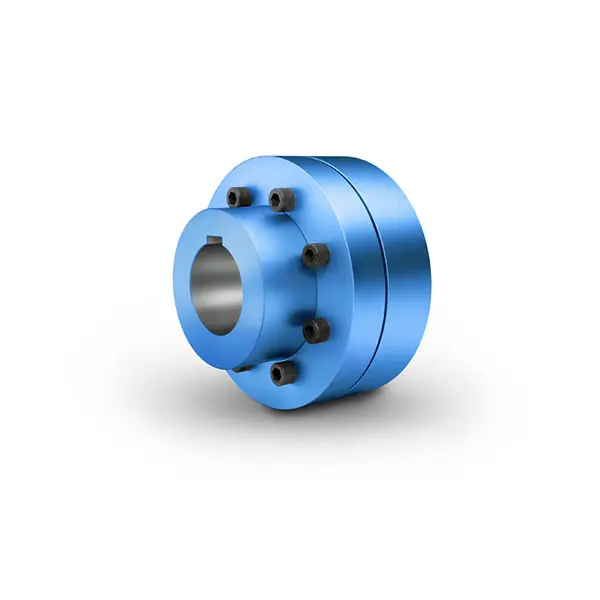

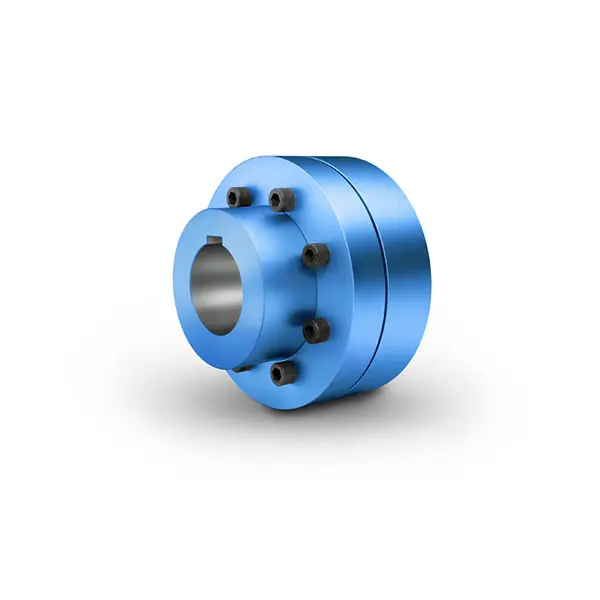

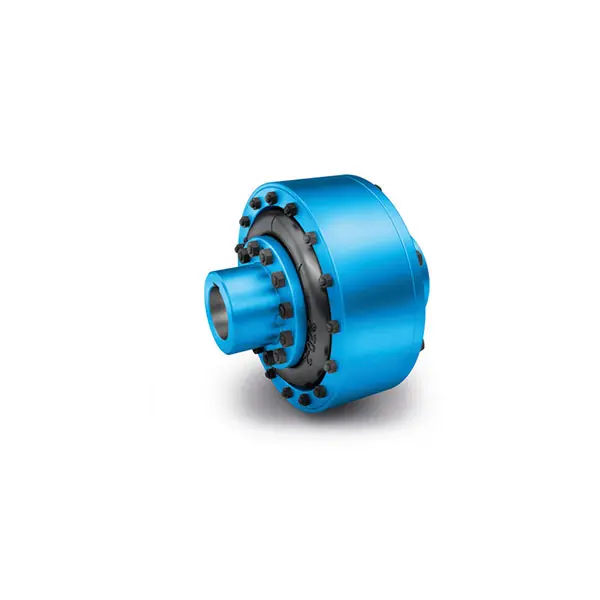

FLENDER Coupling  ZAPEX ZW Torsionally Rigid Gear Coupling

ZAPEX ZW Torsionally Rigid Gear Coupling  ZAPEX ZN Torsionally Rigid Gear Coupling

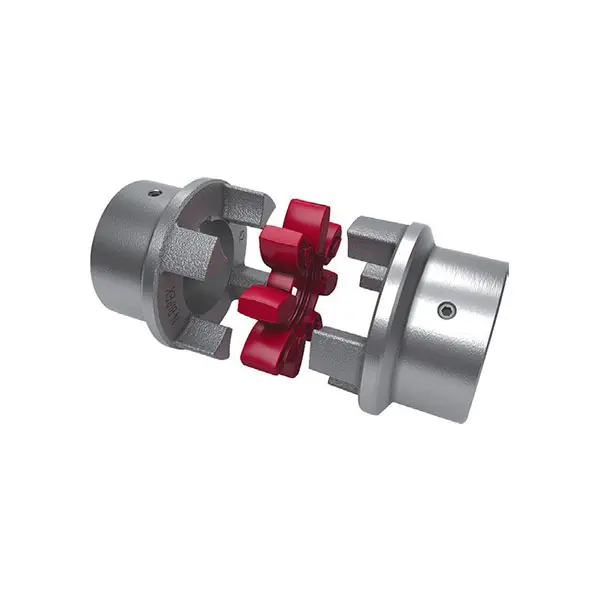

ZAPEX ZN Torsionally Rigid Gear Coupling  N-EUPEX Flexible high performance Coupling

N-EUPEX Flexible high performance Coupling  N-ARPEX Torsionally Rigid All-Steel Coupling

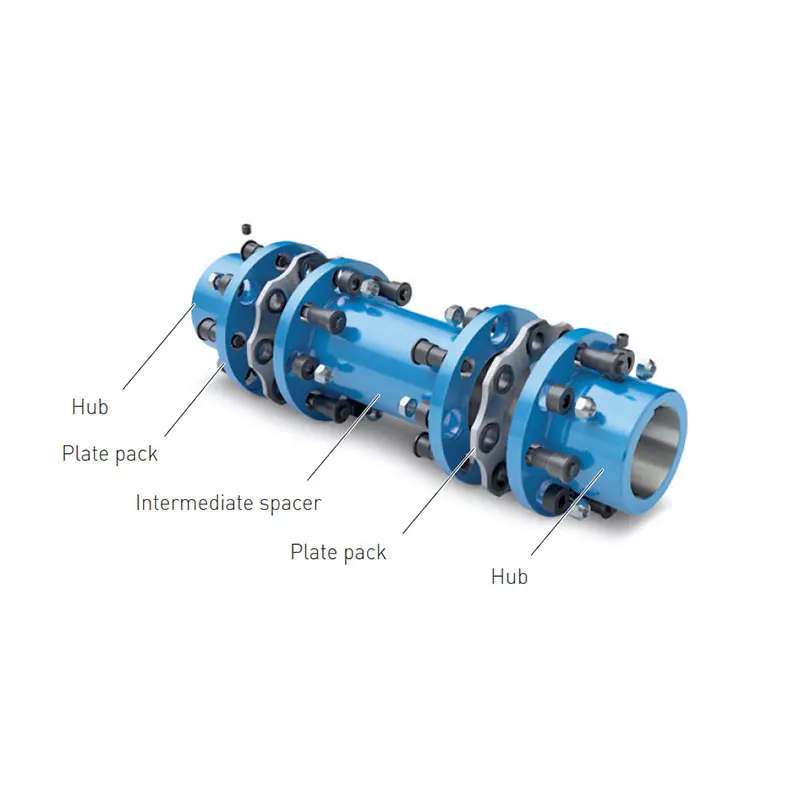

N-ARPEX Torsionally Rigid All-Steel Coupling  ARPEX Torsionally Rigid All-Steel Coupling Spare and Parts

ARPEX Torsionally Rigid All-Steel Coupling Spare and Parts  N-EUPEX DS Flexible High Performance Coupling

N-EUPEX DS Flexible High Performance Coupling  RUPEX Flexible high performance Coupling

RUPEX Flexible high performance Coupling  N BIPEX Flexible high performance coupling

N BIPEX Flexible high performance coupling  ELPEX B Highly Flexible Coupling

ELPEX B Highly Flexible Coupling  ELPEX S Highly Flexible Coupling high performance

ELPEX S Highly Flexible Coupling high performance  ELPEX Highly Flexible Coupling high performance

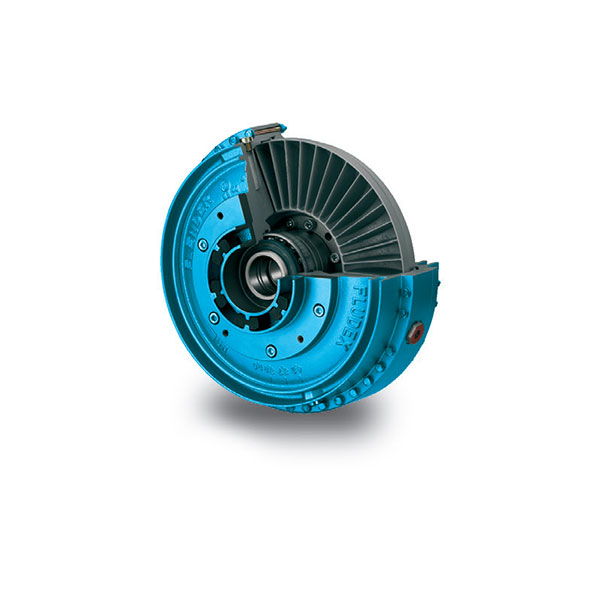

ELPEX Highly Flexible Coupling high performance  FLUDEX Fluid Coupling high performance

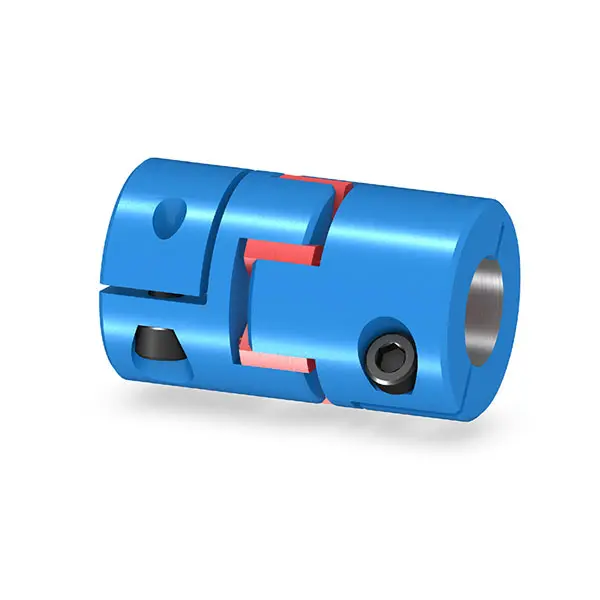

FLUDEX Fluid Coupling high performance  SIPEX Backlash free Coupling high performance

SIPEX Backlash free Coupling high performance  BIPEX S Backlash free Coupling high performance

BIPEX S Backlash free Coupling high performance  FLENDER Coupling Spare Parts high performance

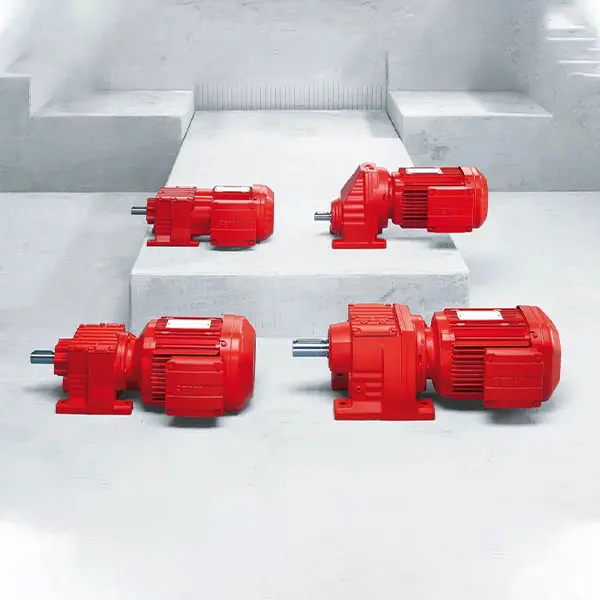

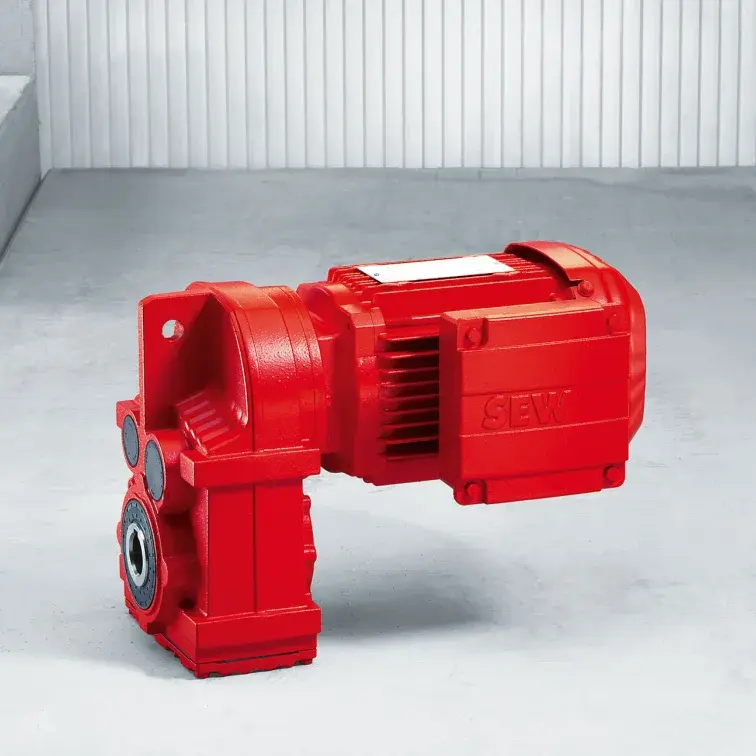

FLENDER Coupling Spare Parts high performance  SEW Gearmotor

SEW Gearmotor

Our Company

News

Case

Contact Us

R Series Helical Gearmotor low voltage

R Series Helical Gearmotor low voltage F Series Parallel Shaft Gearmotor low voltage

F Series Parallel Shaft Gearmotor low voltage K Series Helical Bevel Gearmotor low voltage

K Series Helical Bevel Gearmotor low voltage S Series Helical Worm Gearmotor low voltage

S Series Helical Worm Gearmotor low voltage W Series SPIROPLAN® Right Angle Gearmotor

W Series SPIROPLAN® Right Angle Gearmotor